Farmington Mo Sales Tax . the sales tax rate in farmington, missouri is 9.85%. the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local sales. The combined rate used in this calculator (9.85%) is the result. The current total local sales tax rate in farmington, mo is 8.350%. farmington, mo sales tax rate. the farmington sales tax calculator allows you to calculate the cost of a product(s) or service(s) in farmington, missouri. This is the total of state, county, and city sales tax. the minimum combined 2024 sales tax rate for farmington, missouri is 8.86%. This figure is the sum of the rates together on the state, county, city, and. the 63640, farmington, missouri, general sales tax rate is 9.85%.

from thetaxvalet.com

the minimum combined 2024 sales tax rate for farmington, missouri is 8.86%. farmington, mo sales tax rate. the farmington sales tax calculator allows you to calculate the cost of a product(s) or service(s) in farmington, missouri. This figure is the sum of the rates together on the state, county, city, and. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local sales. This is the total of state, county, and city sales tax. the 63640, farmington, missouri, general sales tax rate is 9.85%. The combined rate used in this calculator (9.85%) is the result. The current total local sales tax rate in farmington, mo is 8.350%. the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%.

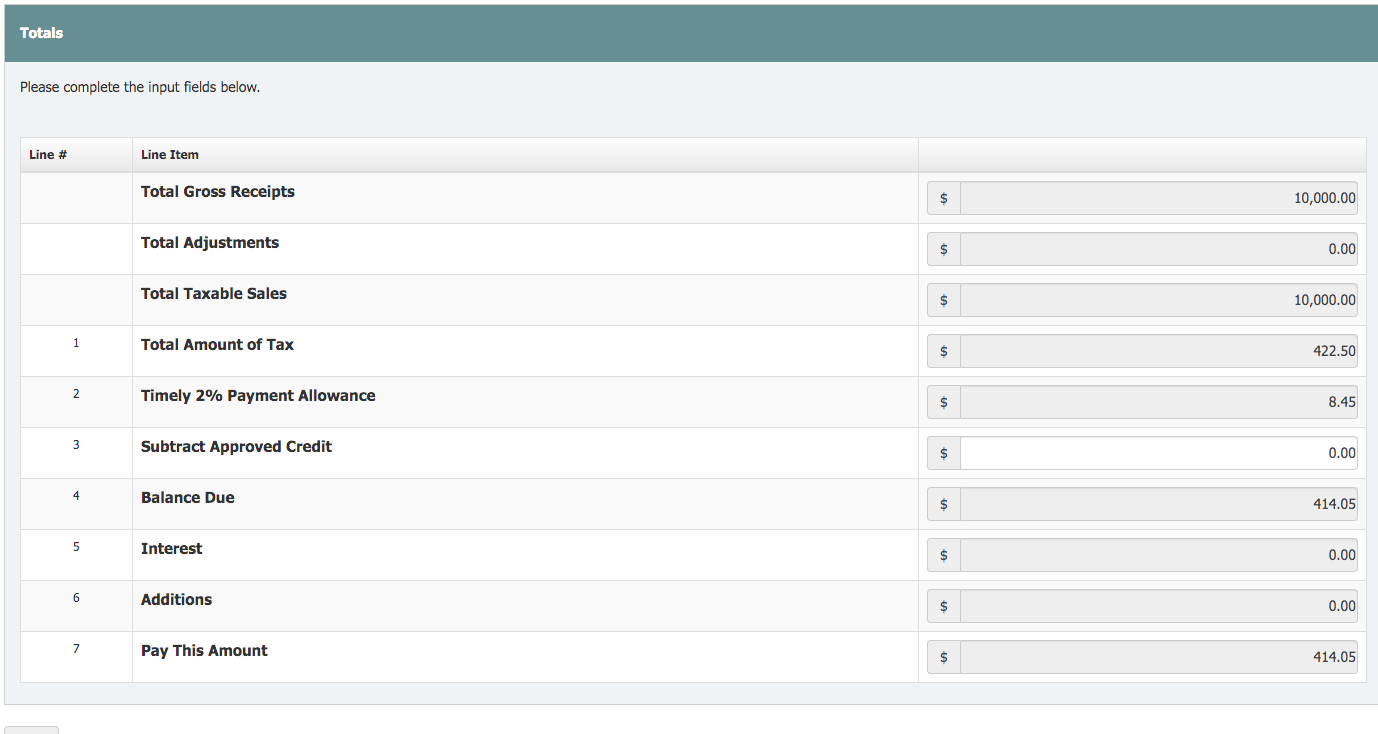

How to File and Pay Sales Tax in Missouri TaxValet

Farmington Mo Sales Tax the sales tax rate in farmington, missouri is 9.85%. The current total local sales tax rate in farmington, mo is 8.350%. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local sales. the 63640, farmington, missouri, general sales tax rate is 9.85%. This is the total of state, county, and city sales tax. The combined rate used in this calculator (9.85%) is the result. This figure is the sum of the rates together on the state, county, city, and. the farmington sales tax calculator allows you to calculate the cost of a product(s) or service(s) in farmington, missouri. the minimum combined 2024 sales tax rate for farmington, missouri is 8.86%. the sales tax rate in farmington, missouri is 9.85%. the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. farmington, mo sales tax rate.

From www.exemptform.com

Missouri Sales Tax Exemption Form Agriculture Farmington Mo Sales Tax the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. This figure is the sum of the rates together on the state, county, city, and. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local. Farmington Mo Sales Tax.

From www.expedia.nl

Bezoek Farmington Het beste van reizen naar Farmington, Missouri in Farmington Mo Sales Tax This is the total of state, county, and city sales tax. farmington, mo sales tax rate. the 63640, farmington, missouri, general sales tax rate is 9.85%. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local sales. The current total local sales tax rate in. Farmington Mo Sales Tax.

From en.numista.com

Missouri 5 Mills (Sales Tax Receipt) * Tokens * Numista Farmington Mo Sales Tax farmington, mo sales tax rate. This figure is the sum of the rates together on the state, county, city, and. the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. the farmington sales tax calculator allows you to calculate the cost of a product(s) or service(s). Farmington Mo Sales Tax.

From www.dontmesswithtaxes.com

Missouri shoppers say show me sales tax free items Don't Mess With Taxes Farmington Mo Sales Tax the 63640, farmington, missouri, general sales tax rate is 9.85%. The current total local sales tax rate in farmington, mo is 8.350%. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local sales. the 9.85% sales tax rate in farmington consists of 4.225% missouri state. Farmington Mo Sales Tax.

From www.realtor.com

Farmington, MO Real Estate Farmington Homes for Sale Farmington Mo Sales Tax farmington, mo sales tax rate. the sales tax rate in farmington, missouri is 9.85%. the 63640, farmington, missouri, general sales tax rate is 9.85%. This figure is the sum of the rates together on the state, county, city, and. the minimum combined 2024 sales tax rate for farmington, missouri is 8.86%. the 9.85% sales tax. Farmington Mo Sales Tax.

From www.realtor.com

Farmington, MO Real Estate Farmington Homes for Sale Farmington Mo Sales Tax the sales tax rate in farmington, missouri is 9.85%. the 63640, farmington, missouri, general sales tax rate is 9.85%. the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. The combined rate used in this calculator (9.85%) is the result. This figure is the sum of. Farmington Mo Sales Tax.

From info.techwallp.xyz

Business Sales Tax Missouri Management And Leadership Farmington Mo Sales Tax the minimum combined 2024 sales tax rate for farmington, missouri is 8.86%. This is the total of state, county, and city sales tax. The current total local sales tax rate in farmington, mo is 8.350%. This figure is the sum of the rates together on the state, county, city, and. the 9.85% sales tax rate in farmington consists. Farmington Mo Sales Tax.

From www.formsbank.com

Top 38 Missouri Sales Tax Form Templates free to download in PDF format Farmington Mo Sales Tax This figure is the sum of the rates together on the state, county, city, and. the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local. Farmington Mo Sales Tax.

From www.youtube.com

Missouri Sales Tax YouTube Farmington Mo Sales Tax the farmington sales tax calculator allows you to calculate the cost of a product(s) or service(s) in farmington, missouri. farmington, mo sales tax rate. The combined rate used in this calculator (9.85%) is the result. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local. Farmington Mo Sales Tax.

From www.realtor.com

Farmington, MO Real Estate Farmington Homes for Sale Farmington Mo Sales Tax The current total local sales tax rate in farmington, mo is 8.350%. The combined rate used in this calculator (9.85%) is the result. the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. the minimum combined 2024 sales tax rate for farmington, missouri is 8.86%. the. Farmington Mo Sales Tax.

From www.dochub.com

Missouri sales tax Fill out & sign online DocHub Farmington Mo Sales Tax farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local sales. farmington, mo sales tax rate. The combined rate used in this calculator (9.85%) is the result. This figure is the sum of the rates together on the state, county, city, and. the 9.85% sales. Farmington Mo Sales Tax.

From www.formsbank.com

Form 53S.f. Sales Tax Return Missouri Department Of Revenue Farmington Mo Sales Tax This is the total of state, county, and city sales tax. the minimum combined 2024 sales tax rate for farmington, missouri is 8.86%. farmington, mo sales tax rate. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local sales. the 9.85% sales tax rate. Farmington Mo Sales Tax.

From itrfoundation.org

Iowa’s Local Option Sales Tax A Primer ITR Foundation Farmington Mo Sales Tax the 63640, farmington, missouri, general sales tax rate is 9.85%. the minimum combined 2024 sales tax rate for farmington, missouri is 8.86%. the farmington sales tax calculator allows you to calculate the cost of a product(s) or service(s) in farmington, missouri. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri. Farmington Mo Sales Tax.

From dxojhdrvx.blob.core.windows.net

How Do I Get A Missouri Sales Tax Id at Tina Roberson blog Farmington Mo Sales Tax The combined rate used in this calculator (9.85%) is the result. the 63640, farmington, missouri, general sales tax rate is 9.85%. This is the total of state, county, and city sales tax. The current total local sales tax rate in farmington, mo is 8.350%. farmington, mo sales tax rate. farmington in missouri has a tax rate of. Farmington Mo Sales Tax.

From www.realtor.com

Farmington, MO Real Estate Farmington Homes for Sale Farmington Mo Sales Tax the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. the 63640, farmington, missouri, general sales tax rate is 9.85%. the farmington sales tax calculator allows you to calculate the cost of a product(s) or service(s) in farmington, missouri. farmington in missouri has a tax. Farmington Mo Sales Tax.

From www.youtube.com

Downtown Farmington, MO 5 YouTube Farmington Mo Sales Tax This figure is the sum of the rates together on the state, county, city, and. farmington in missouri has a tax rate of 8.35% for 2024, this includes the missouri sales tax rate of 4.23% and local sales. This is the total of state, county, and city sales tax. the 9.85% sales tax rate in farmington consists of. Farmington Mo Sales Tax.

From www.realtor.com

Farmington, MO Real Estate Farmington Homes for Sale Farmington Mo Sales Tax The combined rate used in this calculator (9.85%) is the result. the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. the sales tax rate in farmington, missouri is 9.85%. The current total local sales tax rate in farmington, mo is 8.350%. This figure is the sum. Farmington Mo Sales Tax.

From en.numista.com

Missouri 1 Mill (Sales Tax Token) * Tokens * Numista Farmington Mo Sales Tax the 9.85% sales tax rate in farmington consists of 4.225% missouri state sales tax, 1.625% st francois county sales tax, 2.5%. This is the total of state, county, and city sales tax. the 63640, farmington, missouri, general sales tax rate is 9.85%. the sales tax rate in farmington, missouri is 9.85%. the farmington sales tax calculator. Farmington Mo Sales Tax.